What are Neobanks and how do they change the FinTech market?

From the years 2021 to 2025, the global fintech market is expected to grow at a CAGR of 23.58%. Contributing to this growth is the concept of Neobanks. With the advent of new technologies and automation taking every industry by storm, the Neobanks industry is expected to grow at a compound annual growth rate (CAGR) of 53.4% from 2022 to 2030.

The Fintech industry has come a long way from the traditional means of banking; now, with the advent of state-of-the-art technologies, the sector has seen a significant amount of transformations. People have become habitual to the 10-minute grocery deliveries and expect the same with their transactions.

The traditional methods of banking, i.e., standing in long queues, and filling up a huge pile of paperwork, was a tiresome and monotonous task. However, with the incorporation of Neobanks, these tasks have been eliminated.

Let’s understand in detail how these technologically advanced Neobanks have transformed the Fintech market.

How has Neobanks changed the Fintech market?

Ever since their implementation, Neobanks have made banking operations easier and focused on giving customers an overall efficient experience. In recent years, venture capital firms have paid significant attention to neobanks and invested heavily in them.

Furthermore, with the various segments available on the Neobanks applications, the segment of a savings account by the year 2028 is expected to grow at a sizeable market share. Over the course of time, the Neobank platform has upgraded and launched new products as a means to alter the course of the entire fintech market.

Much like the savings account service of the Neobank platform, the segment of personal application is estimated to grow rapidly till the year 2028.

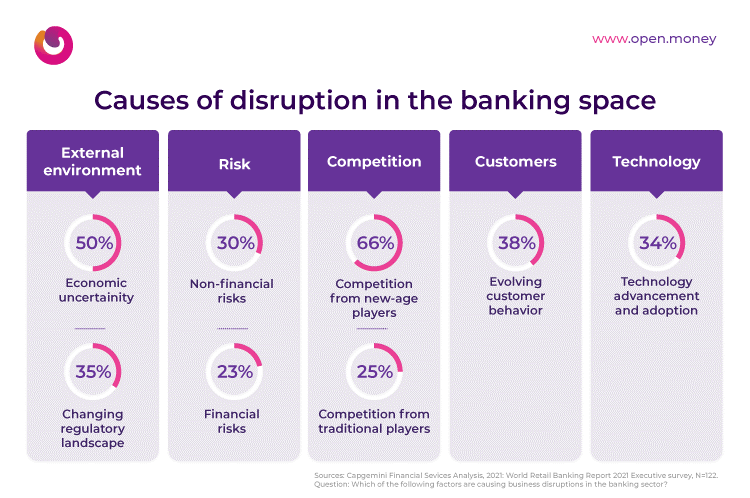

With the state-of-the-art technological concept and ease in banking operations, Neobanks have changed the Fintech market. However, before the advent of the Neobanks, the banking sector was disrupted due to the pandemic and other external factors.

Source: https://www.finextra.com/blogposting/21843/how-neobanks-are-defining-the-future-of-banking

Further, Neobanks have a significant amount of impact on rural areas. Neobanks, or digital banks, have the potential to greatly benefit rural markets that traditional brick-and-mortar banks have underserved. People living in rural areas who have to travel long distances to carry out their banking operations can reap the benefits of a Neobank.

Neobanks have further transformed the whole Customer experience by implementing convenience, a user-friendly interface and an element of personalisation. Neobanks are often more agile than traditional banks and able to introduce new features and services more quickly. They also tend to focus on using technology to improve the customer experience.

The increased competition among neobanks is transforming traditional banks through digital transformation. There has been an improvement in traditional banks’ apps, seamless integration of digital and in-person experiences, more services offered, and the elimination of overdraft fees.

There are benefits to consumers on all levels as a result of this shift. The more competition in banking, the more exciting innovations that will emerge, the more online features and access consumers will have, and the greater financial inclusion they will experience. Financial services like budgeting apps and savings tools are becoming more accessible to traditionally underserved consumers. These tools assist customers in improving their financial health and building real wealth.

Conclusion

From automated services to enhanced customer experience, Neobanks have greatly impacted the Fintech market. Moreover, they can act as a key to becoming profitable entities by convincing traditional banks to invest in new-age technology and streamline processes so customers can experience seamless and swift services.

In the digital age, customers have different expectations from banks, which is why neo-banks are filling the gap between traditional banks and the digital era. In the near future, they may surpass conventional banks in terms of efficiency and profitability.