The concept of financial inclusion was first introduced in India in 2005 by the Reserve Bank of India. It strives at offering banking and financial services to economically underprivileged individuals. It aims to elevate the socio-economic status of individuals regardless of their income or savings, ensuring the marginalized make the best use of their money and receive financial assistance. With the help of technology, more upstarts are making financial inclusion a widespread reality.

The Concept

Financial inclusion refers to the financial access by enterprises and households to reasonably priced and uplifting formal financial assistance. Access to financial services can be basis several dimensions, for instance, geographic, socio-economic, etc. Enterprises and individuals residing at different geographic locations will require distinct services from location-specific providers. Financial inclusion appropriately designs products and services that are sustainable and meet the needs of clients with a reasonable pricing structure. Financial institutions that work towards financial inclusion indulge in different techniques for effective delivery and provisions.

The development and efficiency of financial systems can have an impact not only on aggregate growth but also on contracting disproportionate income distribution and helping people out of poverty.

The Measurement

The sub-indices of Financial Inclusion majorly depend upon the following variables-

- Access sub-index- This value is largely driven by the growth over the years, and recently, in the number of bank outlets manned by own staff, FBCs, total number of savings accounts, post offices, number of subscribers in Mutual Funds (MFs), JAM ecosystem, number of offices for insurance, Prepaid Payment Instrument (PPI) issuers, and Point of Sale (PoS) terminals etc.

- Usage sub-index- Usage has shown highest growth as compared to other sub-indices, driven largely by ‘Insurance’, ‘Credit’ and ‘Saving & Investment’. Some of the indicators under these dimensions which have shown substantial growth include total number of credit accounts, amount outstanding in the credit accounts, volume and value of Unified Payments Interface (UPI) transactions. Increased use of direct benefit transfer (DBT) for various government programmes also had a positive impact on the index value through higher outstanding amounts in Savings Bank (SB) accounts.

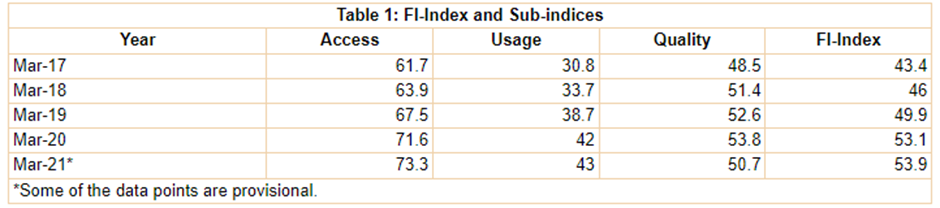

Of the three sub-indices, FI-Access with the index value at 73.3, expectedly, is higher as compared to both FI-Usage (43.0) and FI-Quality (50.7) which indicates that building blocks for greater financial inclusion in the form of financial infrastructure put in place over the years needs to be built upon by deepening the FI through focusing on promoting ‘Usage’ and improving ‘Quality’.

However, before investigating what influences the measurement in financial inclusion, it is imperative to assess the impact of financial inclusion on society as a whole. Several financial inclusion indicators depend upon multiple variables like outreach, usage, quality, etc.

The objective to establish indicators are as follows-

- Include as many economies while maintaining originality to avoid bias results for a cross country setting

- Standardizing the measure for all countries to develop a consistent and robust method of financial inclusion

- To validate other findings

To reach a measurement, surveying the people keeping in mind the socio-economic factors like occupation, income, literacy, rural debt value, etc. are vital along with understanding perception and acceptance of the services. Understanding the perception will allow financial institutions to device services accordingly while measuring the impact of these services on households.

Another important aspect for measuring the efficacy of financial inclusion is collecting information on credit data, deposits, remittances, insurances, etc. The idea is to measure the impact and not simply open a bank account for the underprivileged.

One of the main challenges in the measurement of financial access is the distinction between access to financial services and actual use of services. This is because of the presence of voluntary exclusion in the system. As per a study, 33% of the people voluntarily exclude themselves from financial assistance. This may be due to several reasons like lack of knowledge, cultural barriers, religious beliefs, etc. Therefore, measuring the proportion while regarding the voluntary exclusion is difficult.

The measurement of financial inclusion is complex, attached with several layers and most importantly, linked to a perception of different researchers. Although the measurement calculates basis 3 vital aspects- financial participation, financial capability and financial well-being, the exact measurement is still a far-fetched objective.

The concept and measurement of financial inclusion will face several hurdles but ultimately bring effective policies and comprehensive services that will benefit and uplift the underserved and underprivileged.