‘Finance’ has always been an indispensable part of our society. Earlier, an unorganized lending system reigned the market that was then taken over by an organized brick and mortar model and today, with advancement, Fintechs are competing fiercely for a substantial stance.

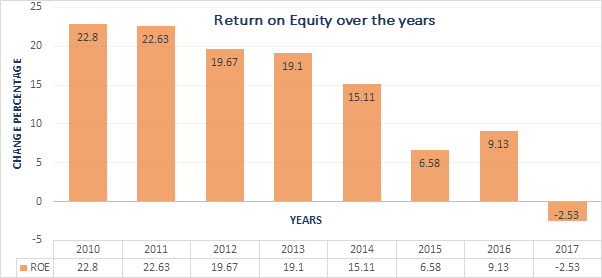

Gone are the days when the idea of integrating finance with technology was a fantasy for a bunch of visionaries. Today, it is here and now! Since the financial crisis in 2008, the banking landscape has been undergoing a steady change. The Return on Equity (ROE) has fallen considerably challenging the existence of traditional financial institutions.

The said transformational change can be attributed to the overall evolution of the banking system. But, certain gaps accelerated the revolution of a contender; Fintechs. Stated are a few key gaps that paved the way to the rise of Fintechs-

- Adoption of Digital Transformation- As per a report by the Massachusetts Institute of Technology (MIT), going digital can reduce the costs of banking by a massive 60–80%. But, since banks have limited their footprint to fundamental offerings like lending, investment, cards, etc., they are quite late in joining the digital wave. Banks earn by adding layers and keeping their operational activities complex and so, the customers have become weary of it. By bringing in technology, Fintechs have taken advantage of this fatigue.

- Patrimonial Infrastructure- The core banking solution is composed of old data sets that are being used around the globe to this day. Earlier, the said infrastructure offered banks stability and security but with new alternatives creeping in, these data sets come across as medieval. However, the said infrastructure is so deeply integrated into the banking system that changing any aspect may do more harm to the system than good. Hence, banks choose to remain risk-averse and skip the adoption of alternatives.

- State of Art Services- Traditional banks enjoyed a monopoly for the longest time until Fintechs challenged them. Whether it was lending or payments, customers were hassled by complex procedures and timelines. Fintechs are enriching customer experience by doing away with vile operational activities. Moreover, with the help of Artificial Intelligence, they are offering customers exactly what they need! While Fintechs have been more customer-centric, traditional banks were more money-centric.

- Inadequate Customer Engagement- Since financial institutions worked in a reverse order earlier wherein they waited for a customer to approach them, customer engagement did not hold any gravity. Informing customers of all their available options and choosing a state of art service is an evolution brought by Fintechs. Where financial institutions have attributed more importance to business, Fintechs have switched the attention to Customer Engagement and Experience (CX).

- CAPEX model- Traditional financial institutions have often been thick in the book owing to the CAPEX model they follow. With inherent expenditures, it is almost impossible for traditional financial institutions to pass on any extra benefit to their customer, a loophole Fintechs have heavily banked on.

- Introduction of CryptoCurrency- Although cryptocurrency has not received a green signal from the regulatory bodies in India, it holds the potential to become a disruptor. Its underlying program can simplify several financial processes. While money has been a vital part of our lives for centuries, converting it into a digital asset will enhance customer journey and experience.

- Financial Assistance to MSMEs- While financial institutions neglected MSMEs owing to their sporadic business cycles and cash flow, Fintechs specifically targeted the sector. For instance, Niyogin Fintech Limited, a unique early-stage Fintech, offers impact-centric financial assistance to MSMEs intending to empower them. Traditional financial institutions have always been wary of testing deep waters and appraising their product and service stack.

At present, 1.7 billion adults remain unbanked globally of which, two-thirds of them own a mobile phone. While the limitations faced by financial institutions retrained them from penetrating markets, Fintechs are moving head on to cater to all the untouched segments thus, filling the void left by financial institutions.