Financial Literacy and the need for Financial Inclusion

Financial literacy is an extensive concept that involves several aspects like budgeting, saving, investing, debt management, financial planning, etc. It encompasses the ability to make informed and responsible financial decisions that can positively impact an individual’s financial well-being.

Financial inclusion, on the other hand, refers to the accessibility and availability of financial services to all individuals, including those who are traditionally excluded from the mainstream financial system, such as low-income individuals, rural populations, women, and minorities.

Financial inclusion aims to provide affordable and appropriate financial services, such as savings accounts, credit, insurance, and payment services, to empower individuals to manage their finances effectively and participate in the formal economy.

Safe to say, financial inclusion and literacy work hand in hand. Each of these aspects cannot be weighed or regarded individually and must be dealt with in its entirety together.

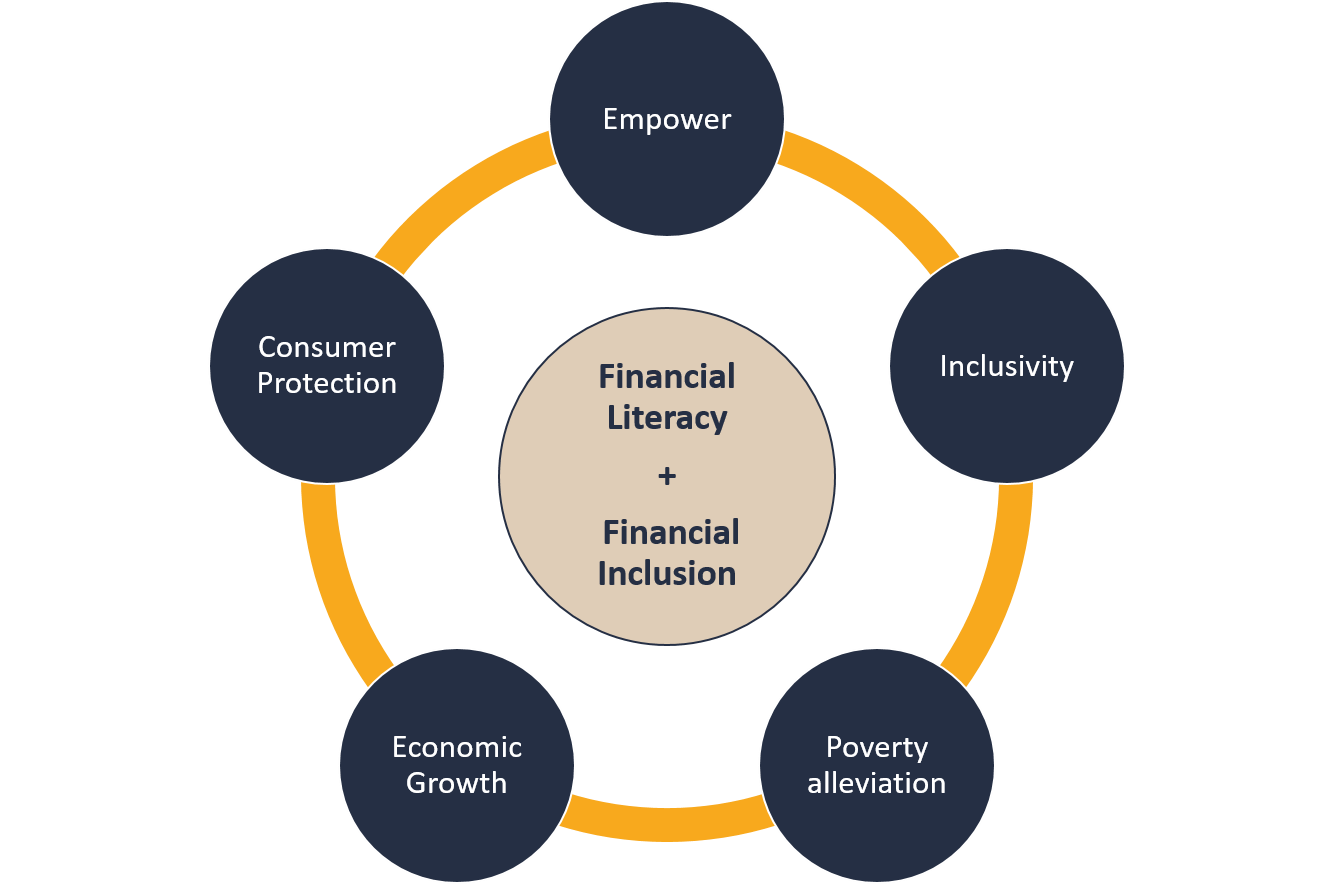

The need for financial literacy and financial inclusion is paramount for several reasons:

Empowerment:

Financial literacy equips individuals with the knowledge and skills necessary to make informed financial decisions, manage their money effectively, and achieve their financial goals. It empowers individuals to take control of their finances, make wise investment choices, and protect themselves from financial risks. 73% of Indians still await to be empowered as only 27% are financially literate meaning the rest have no access to financial services.

Inclusivity:

Financial inclusion ensures that all individuals, regardless of their socio-economic background, have access to affordable and appropriate financial services.

It promotes economic participation and social mobility by providing opportunities for savings, credit, and investment, which can help individuals build assets, start businesses, and improve their standard of living.

As of March 2022, the FI Index was 56.4 which fared better than the previous year’s however, given India’s 140 crore population, the efforts need to be doubled!

Poverty alleviation:

Lack of financial literacy and limited access to financial services can contribute to poverty and financial vulnerability. Financial literacy education, combined with accessible financial services, can enable individuals to develop sound financial habits, build savings, and make informed decisions about borrowing and investing, thereby breaking the cycle of poverty.

As per a survey conducted by the Demographic and Health Survey before the pandemic struck, 16.4% of India’s population live in poverty, 4.2% live in severe poverty and roughly 18.7% fall into the vulnerable to poverty zone. This gives us a sense of how important financial inclusion is to empower the said population.

Economic growth:

Financial inclusion can foster economic growth by bringing more individuals into the formal financial system. Increased financial literacy and access to financial services can lead to higher savings, investment, and entrepreneurial activities, which can stimulate economic growth at both the individual and societal levels.

For instance, 63 million MSMEs in India account for close to 30% of the GDP. Yet, they were severely underserved until recently. With Fintech joining the force with banking institutions, the scenario is steadily changing. This change will reflect on the GDP too as MSMEs and the underserved population will be empowered.

Consumer protection:

Financial literacy equips consumers with the knowledge to understand financial products and services, compare options, and make informed decisions. Financial inclusion ensures that individuals have access to fair and transparent financial services that are suitable for their needs, protecting them from predatory practices and promoting financial well-being.

For example, with 45.36 crore internal migrants in India constituting 37% of the country’s population, Domestic Money Transfer plays a significant role.

Without financial literacy, a large number of this population was defrauded by intermediaries. However, with a sufficient amount of literacy, this challenge is being eliminated to a large extent.

In Conclusion

financial literacy and financial inclusion are essential for promoting financial well-being, economic growth, and social inclusion.

By empowering individuals with financial knowledge and providing them with accessible financial services, we can foster a more financially inclusive society where everyone has the opportunity to thrive and participate in the formal economy.