Hyperautomation through AI and ML

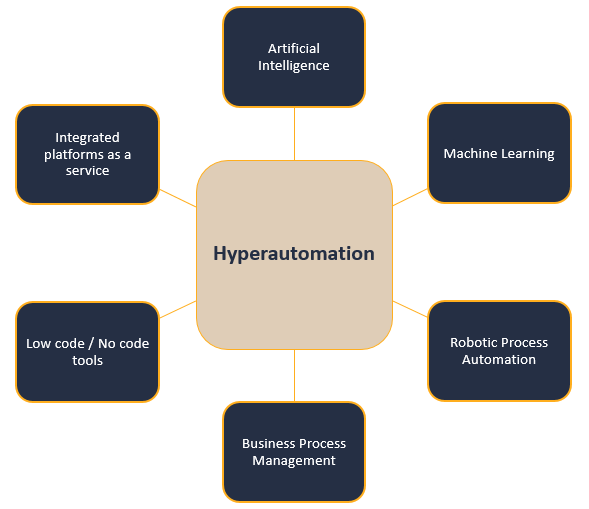

Hyperautomation in the financial domain refers to the integration of artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA) to automate complex business processes, reduce manual interventions and improve operational efficiency. It has become critical to everyday operational activities.

AI and ML are critical components of hyperautomation because they enable automation tools to learn from data and improve over time. With AI and ML, hyperautomation can process large volumes of data, identify patterns, and make predictions based on that data. This allows organizations to automate a wide range of tasks and processes, including decision-making, data analysis, and customer service.

One of the key benefits of hyperautomation is that it can help organizations improve their efficiency and reduce costs. By automating repetitive and time-consuming tasks, hyperautomation frees up employees to focus on more strategic work. Additionally, hyperautomation can help organizations make better decisions by providing real-time data and insights.

Components of Hyperautomation

Let’s have a look at some of the altering hyperautomation processes that the financial domain has adopted –

Account Opening and KYC (Know Your Customer)

Hyperautomation has automated the entire account opening process including identity verification, credit checks, document processing, etc. The cherry on the cake is its ability to identify fraudulent applications and reduce the risk of financial crime.

Hyperautomation has furthered this progress and today we also experience the ease of e-KYC where the entire journey along with the facial verification takes place online.

Loan Processing

The lending process was always considered a cumbersome process regardless of the amount of money one wanted to borrow. However, with hyperautomation, the process has not only become simpler but the disbursals have become quicker too.

The redesigning of the loan processing cycle, loan application verification, eligibility checks, credit scoring, documentation, etc.

has allowed banks and NBFCs to reduce their disbursal duration drastically since it eliminated several manual processes.

This has additionally helped financial institutions better customer experience too.

Risk Management

Lenders have always been in the high-risk zone inspite of designing risk-averse strategies for themselves. With the introduction of hyperautomation, the scenario has changed for lenders. Artificial Intelligence (AI) and Machine Learning (ML) now analyze vast amounts of data to identify potential risks and provide insights to decision-makers.

Moreover, it has also enabled real-time monitoring of risks allowing businesses to quickly respond to threats, fraudulent activities, changing market conditions and regulatory requirements.

Customer Service

Customer Experience (CX) has become an integral part of customer service. Experience is directly proportional to retaining a customer. With chatbots and voice assistants handling customer queries and grievances 24×7, services have become more personalized inspite of the reduction of personal touch.

The Gen-Z prefers customization and personalization over personal touch and therefore, hyperautomation has been on the boom.

To form an opinion, hyperautomation in the financial domain has the potential to transform the industry by reducing operational costs, improving accuracy, and enhancing customer experiences.

It can also enable financial institutions to stay competitive by adopting the latest technologies and staying ahead of regulatory changes.