Introducing Supply Chain Finance

Supply Chain Finance (SCF) is a technology solution that lowers financing costs for buyers and sellers. It tracks invoice approval and settlement and automates transactions to improve the efficiency of all the parties involved in a sales transaction. The supply chain financing market is expected to reach a CAGR of 17.1% by 2024.

According to Mckinsey reports, SCF eligibility will increase from less than 40% to as much as 80% in the upcoming years as supply chain leaders are looking for better solutions. By 2031, the supply chain finance market is expected to reach $13.4 billion.

Indian Supply Chain Financing Ecosystem Challenges

Compared to global trends, India’s supply chain financing (SCF) is still nascent. Indian MSMEs employ more than 11 crore people and contribute 29% of the GDP. Also, 70% of MSMEs require working capital funds. However, SCF remains inaccessible due to the legacy banking systems. Many MSMEs don’t meet the banking requirements criteria. The estimated credit gap is Rs. 20-25 trillion.

This credit gap forces the MSMEs to approach third-party lenders, which results in higher costs, stunted growth, low profitability, and a volatile business model. The COVID economic disruption doesn’t help either. The low-cost SCF option provides extended financing for MSMEs and helps lenders manage credit risks.

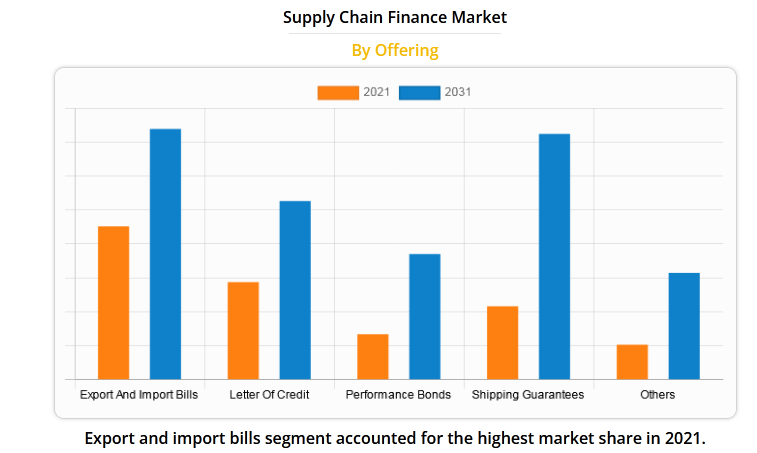

Source: Allied Market Research

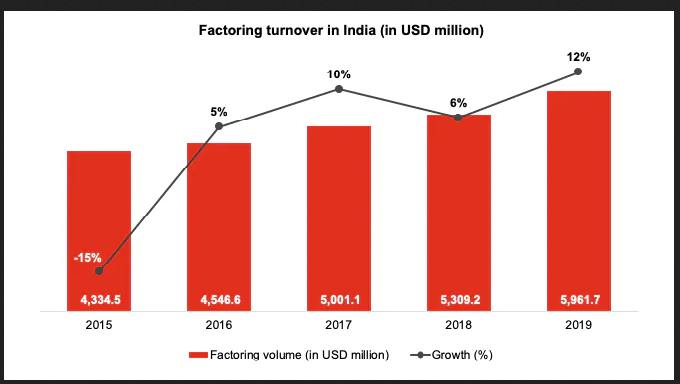

According to the new Factoring Regulations Act 2011, more than 182 NBFCs can now offer factoring services. Previously, NBFCs could meet only 20% of the funding requirements for MSMEs.

Digitisation Is Paramount To SCF Innovation

Digitisation is the key to achieving seamless SCF solutions for Indian MSMEs. Businesses will have access to more customised SCF products that help increase the working capital. Apart from invoices, businesses can benefit from other fintech offerings such as a letter of credit, import and import bills, shipping guarantees, performance bonds, and more. Technology innovations such as fintech digital delivery, industry utilities, API technologies, and blockchain bring supply chain financing closer to SMEs.

With the non-availability of credit history, lenders can use AI-based risk assessment solutions to evaluate creditworthiness. Such solutions also predict business growth, enabling lenders to offer SCF financing.

Source: PWC

Fintechs can bring about innovation in SCF solutions in the following ways:

- Incorporate API-enabled services using a customer-centric tech stack.

- Use data to understand supply chain networks to innovate new opportunities.

- Use blockchain-distributed ledgers to improve the transparency of the financing platform.

- Introduce innovative products such as CAPEX discounting, invoice discounting, warehouse receipt finance, dynamic discounting, early cycle discounting, and SCF securitisation.

Various initiatives from the Government of India encourage SCF. The fintech platforms can use the existing rails to improve their SCF offerings in the following ways:

- Leverage TReDS and GSTN linking to understand MSME cash flows for invoice financing better.

- Use the AA framework to provide financing options for suppliers and buyers.

India’s addressable supply chain market is estimated to be Rs. 60,000 crores, while the total market value is Rs. 18 lakh crore. Digital supply chain solutions facilitate fully trackable transactions to seamless trading between buyers and suppliers.