Multiexperience in Digital Transformation

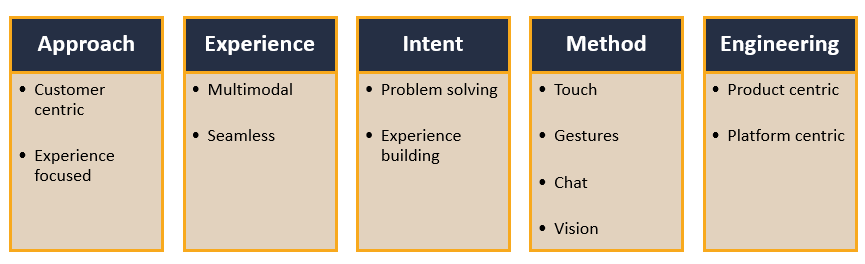

Multiexperience is the practice of creating digital experiences across multiple touchpoints, such as mobile devices, wearables, smart speakers and other connected devices whereas digital transformation is the process of using digital technologies to fundamentally change the way businesses operate and deliver value to their customers.

In the context of digital transformation, multiexperience plays a crucial role in enabling organizations to provide seamless, intuitive, and engaging digital experiences to their customers across different channels and devices. By leveraging a multiexperience approach, businesses can create a consistent user experience across various touchpoints, which can lead to increased engagement, customer satisfaction, and loyalty.

Customers today are attracted to any service that gives them a sense of seamlessness and enhanced experience. Multiexperience platforms ensure customers are provided with what they need and get used to such services for the future. Its enhanced workflows and ability to mitigate repetitive tasks allow internal operational smoothness that also reflects on the front end for the customers to enjoy.

Furthermore, multiexperience also means new technologies and approaches are tested for better CX. For instance, experimenting with AI, AR/VR and voice interfaces to create engaging and personalized digital experiences. This gives businesses a competitive edge over others as embracing digital transformation is the need of the hour. It will surely help businesses stay ahead of the curve in terms of customer expectations and market trends.

Another very interesting aspect of multiexperience is the amount of data it is capable of collecting. This characteristic gives great insight into customer behaviour, preference, need and trend, enabling businesses to make data-driven decisions. In the long run, this gives businesses a complete understanding of what a customer needs and wants.

For a better understanding, let’s peep into how the finance industry leverages multiexperience modes. Alongside physical stores, banks invest heavily in web portals and mobile applications. The user is offered multiple methods to handle their account and from any location. Financial institutions also indulge in digital marketing activities on these platforms to give users insights or inform them of new services, products and features. Given that multiexperience can help businesses improve development by 10 times, it has become more of a strategy to build a business nowadays and any business that does not conform to this change, lags in its growth.

Multiexperience Summary

In conclusion, multiexperience is a critical component of digital transformation, enabling businesses to provide more engaging and personalized digital experiences across multiple touchpoints and devices, while improving operational efficiency and fostering innovation.