The Significance of Regional Rural Banks in India

The Regional Rural Banks (RRBs) were established in India in 1975 with the objective of developing its rural economy through inclusive banking services. RRBs are jointly owned by the Government of India (GoI), the respective state government and a sponsor bank with the intention to elevate and empower the population under their governance.

When the foundation of RRBs was laid by the Narsimham committee, 5 RRBs were set up with a total authorized capital of Rs 1 crore which was later increased to Rs 5 crore. The 5 commercial banks picked to sponsor RRBs were Punjab National Bank, State Bank of India, Syndicate Bank, United Bank of India and United Commercial Bank. The equities of rural banks were divided in a proportion of 50:35:15 among the Central Government, the Sponsor Bank and the concerned State Government, respectively.

With a clear intention to upraise rural areas, RRBs were put in place to ensure the following responsibilities were undertaken and achieved –

- Taking the banking services to the doorstep of rural masses, particularly in unbanked and underserved rural areas.

- Identify the financial need, especially in rural areas.

- Making available institutional credit to the weaker section of society who had by far little or no access to cheaper loans and had been depending on informal credit sources.

- To enhance banking and financing facilities in backward, unbanked or underserved areas.

- Mobilize rural savings and channel them for supporting productive activities in rural areas.

- To provide finance to the weaker sections of society like small farmers, rural artisans, small producers, rural labourers, etc.

- To create a supplementary channel for the flow of the central money market to the rural areas through refinances.

- To provide finance to co-operative societies, Primary Credit societies and Agricultural marketing societies.

- Generating employment opportunities in rural areas and bringing down the cost of providing credit to rural areas.

- Enhance and improve banking facilities in semi-urban, rural and other untapped markets.

If driven correctly, the elevation will also result in attaining financial inclusion since it has the capability to tap the rural population till the last mile. Apart from this, it ensures a financial safety net for the customers willing to avail of services from RRBs while increasing the supply of money and mobilizing savings in the rural market. The safety net encourages public confidence in the financial system and thus helps to increase its network so as to reach every segment and level of society.

Understanding the significance of RRBs

RRBs have played a pivotal role in driving financial inclusion in rural areas where the population was largely underserved. Bringing banking services to their doorstep was indeed a revolutionary step that set the rails for other financial institutions to join forces. This has further also led to the creation of employment opportunities in rural areas. With more financial service providers tapping the said market, rural individuals are able to launch and grow small-scale businesses that are leading to employment opportunities at large.

Furthermore, it is a known fact that infrastructure is a challenge in rural areas and hence, many financial institutions, banks, NBFCs, etc. refrain from catering to rural needs. The acquisition cost coupled with the infrastructure cost and slow growth has forever been a hindrance. However, RRBs are bridging the gap by simply existing in rural areas and giving other banks and NBFCs a push in terms of infrastructural assistance. This has further helped in the development of industries, agriculture, small-scale businesses, etc.

The entire existence of RRBs has helped in bringing financial stability to rural areas by channelizing their savings into productive investments and by also providing credit facilities to small-scale entrepreneurs.

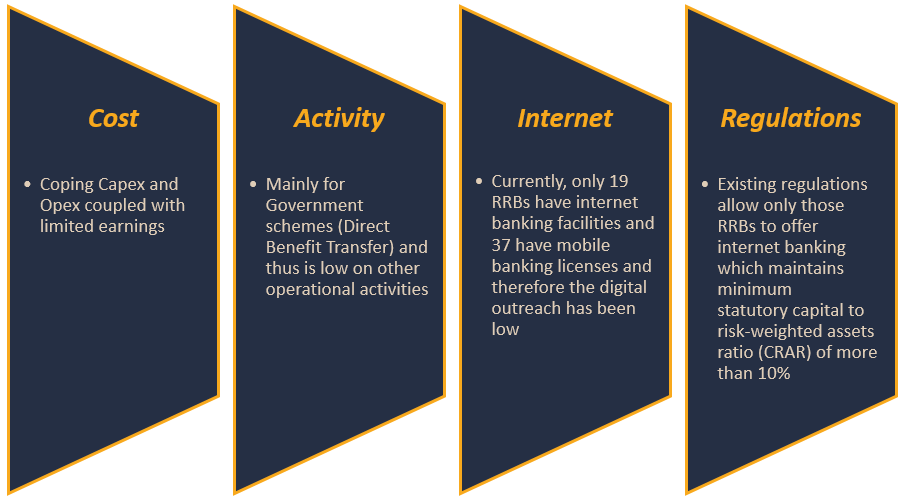

In spite of all the pros we’ve understood until now, RRBs have their own set of challenges, here’s what –

Over the years, the GoI has played a significant role in involving other institutions and individuals to build on this goal. Whether it was establishing NABARD to support sustainable growth or currently formulating a roadmap to introduce 22 more RRBs, the GoI is working tirelessly to uplift the segment in conjunction with RRBs. As per data, the government has contributed Rs 4,084 crores towards RRB recapitalization in 2021-22, of which Rs 3,197 crores has been released to 21 lenders with a focus on financial inclusion by leveraging technology.

Collaborating with technology has been a ‘super move’ that will take the growth trajectory at twice the speed. However, for now, RRBs have been instrumental in bringing banking services to rural areas, promoting agricultural development, creating employment opportunities, developing rural infrastructure, and providing financial stability to the rural financial system. They continue to play a significant role in the development of the rural economy in India.