What is the future of Cryptocurrency?

The cryptocurrency was first introduced in the year 2008 after the financial crisis that shook the entire world. It gained momentum in India post-2015 after it showcased the potential it holds. At present, over 15 million people own cryptocurrency in India with total holdings of around Rs 400 billion. Moreover, cryptocurrency has massive institutional buy-ins who are still trying to figure out how to put it on their balance sheets. Amongst all cryptocurrencies, Bitcoin is the first and the most common cryptocurrency in India.

The Government of India (GOI) has controlled the trading of cryptocurrencies in India full-fledged owing to its lack of regulatory options. Cryptocurrency operates outside the control of governments and central banks making it difficult for regulatory bodies to implement laws on it. The GOI only wants certain cryptocurrencies circulating within the economy to promote the underlying technology.

Although Finance Minister, Nirmala Sitaram has notified that the GOI has no plans to recognize Bitcoin as an official form of Indian currency, nonetheless, they are devising a plan to introduce selective cryptocurrencies to the economy through a new Crypto Bill. The GOI is likely to treat cryptocurrency as an asset rather than a currency. This will allow them to get tax returns on crypto assets.

Furthermore, the RBI is in talks to amend the RBI Act 1934 to include digital currency under the definition of a banknote. They have been examining use cases and working out a phased implementation strategy for the introduction of Central Bank Digital Currency (CBDC) to the economy. CBDC will augment financial inclusion, a global objective, and can be pushed through the central bank.

Cryptocurrencies and CBDC both are technology-driven but have their own set of differences. Cryptocurrencies can transform the banking system globally by increased economic growth, reduced poverty and financial inclusion. It has a strong technology backing it. The blockchain, a distributed ledger record transaction, ensures that the system is decentralized and secure from privacy intrusions.

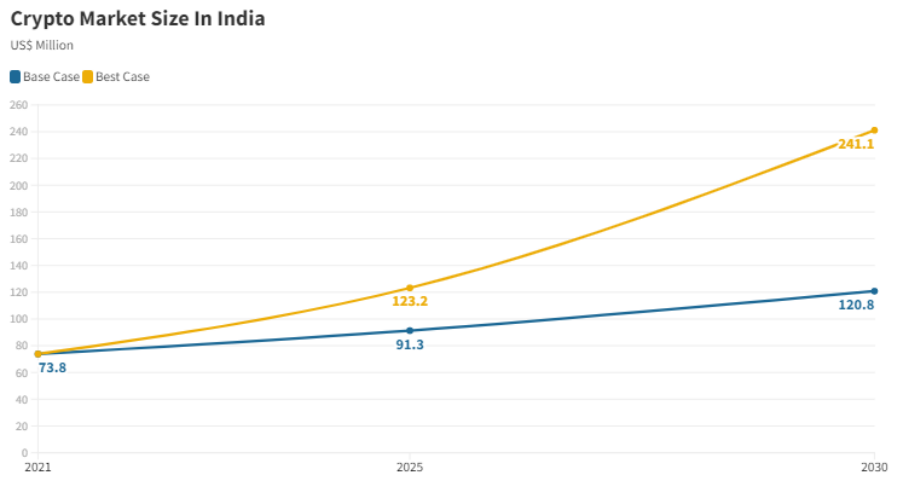

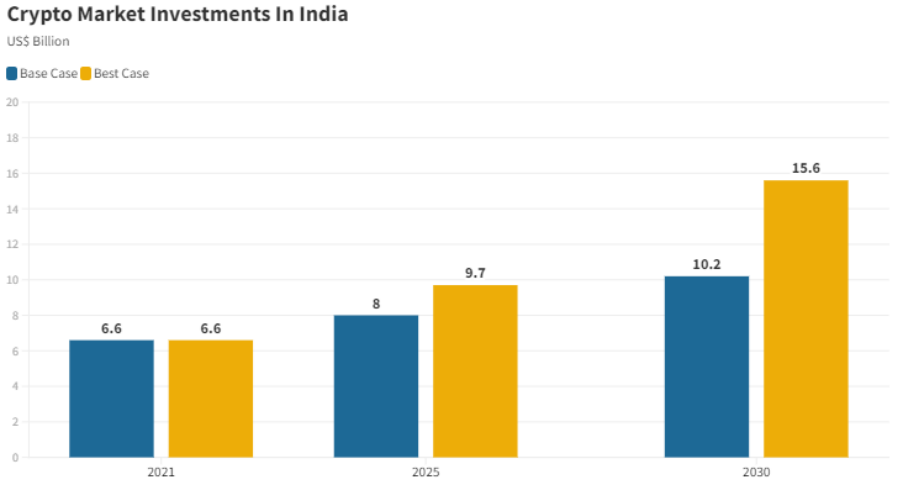

The way forward for cryptocurrencies is still under wraps but considering its global appeal, India may soon adopt selective cryptocurrencies. Individuals and companies both are heavily investing in cryptocurrencies citing the notion that the future will be led through digitalization and interestingly, the population from tier 2 and 3 cities are the early adopters of this transformation.