Who are the Fintech Borrowers?

India as a market is fairly complex and dynamic in terms of geography, consumer behavior and preferences. The consumer market is vast and diverse for any given product or service. Needless to say, the unifying force in all these segments is the acceptability and usage of mobile connectivity, application and platform. Fintech has anchored a spot for itself in this vast market by leveraging the ubiquity of mobile connectivity and internet connection.

While Fintech has penetrated the market with need-specific products and services, it is interesting to understand who are the borrowers largely- the underserved or the credit-worthy borrowers.

Fintech lenders target areas where traditional banks do not operate or have very little intervention. Due to their low fixed costs, Fintech has laxer lending standards. Therefore, the entry of Fintechs has aggregated credit frictions and imperfect competition between traditional financial institutions and Fintech.

The increase in competition has led to access to credit for financially constrained and underserved households and MSMEs, respectively. Furthermore, the use of data analytics also enables Fintech lenders to capture credit-worthy borrowers.

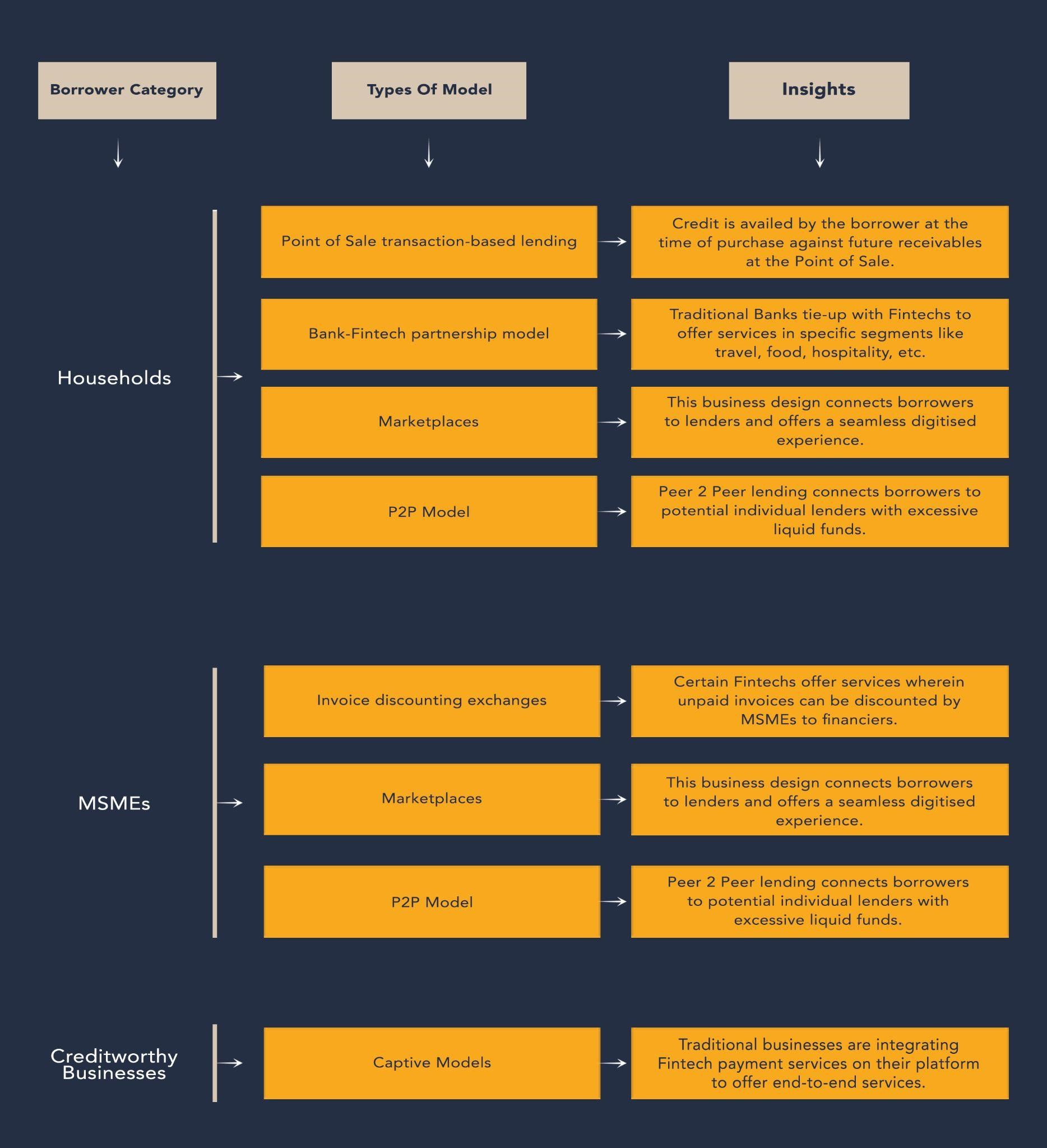

The different business models that Fintech has devised and observed allow them to cater to larger demographics-

As per data, personal credit is one of the fastest-growing products in the lending business. Fintechs seem more interested in unsecured lending owing to its standard policy, loan size, quick maturity period and interest rate. While traditional banks focus on more credit-worthy borrowers, borrowers from Fintechs, although more diverse, are predominantly the underserved ones. Fintech lenders start with less credit-worthy individuals and slowly branch out and increase their market share. As per reports, most Fintech borrowers have credit scores in the mid-range, i.e., between 640-720.

Traditionally, unsecured lending in India is majorly controlled by community finance- a segment of focus for Fintech today. Fintech is filling the credit gap and offering receivables financing, working capital financing, equipment financing, unsecured financing, etc. and is eyeing the borrowers who require these.